Melanie D. Perry has been helping people create sustainable wealth by making wise decisions for over two decades as a Certified Financial Planner™. Melanie’s passion for financial literacy extends to educating women and kids about the basics of money management through her financial literacy and education company, Zeallionaire Enterprises. She is known for making financial concepts easy to understand which helps people to make sound and empowering financial decisions. Melanie caters to women entrepreneurs by providing solid strategies that work. She has been recognized by many national organizations for these efforts including the Los Angeles Women’s Chapter of the NAACP. Melanie has authored All about the Benjamins: Helping People Create Wealth in the Midst of Financial Insanity and Johnathan and Geneva: The Adventures of Zeallionaire Kid”, her latest book for elementary children.

What does “entrepreneurship” mean to you?

Melanie Perry: Empowerment. As an entrepreneur in the field of financial planning and coaching, I’m able to inspire others to take strategic action on achieving their ultimate life. I empower them with the financial knowledge and tools to build wealth that can end generational poverty in their family, enjoy all that life has to offer, and make a positive impact in society.

Melanie Perry: Empowerment. As an entrepreneur in the field of financial planning and coaching, I’m able to inspire others to take strategic action on achieving their ultimate life. I empower them with the financial knowledge and tools to build wealth that can end generational poverty in their family, enjoy all that life has to offer, and make a positive impact in society.

Tell us about your first experience with entrepreneurship.

MP: I was in high school. I sold candy on the DL (down low) to my classmates. It was a very lucrative business. I got the idea from my best friend. She was doing it and ended up changing schools. So, I continued what she started. I offered no friend and family discounts, either. People paid full price and I didn’t get caught. Someone tried to steal from me, but I was smart enough to keep my money on me and not in my purse or locker. I was heartbroken when someone broke into my locker and took my purse, but the money was on me. I kept selling but I learned there were a thief among me, so I kept my guard up.

What is your company’s origin story? What is the biggest reason you started your business? What did those early days look like and teach you?

MP: Zeallionaire Enterprises came about by default. I was compelled to write a book around the time of the Great Recession in 2008. At that time, I had been a financial advisor for roughly ten years, and I was full of people’s pains and triumphs around money. However, the greater issue was more so the lack of how money works and how culture and spirituality effected women and people of colors money paradigm. The book was designed to help people heal their money wounds. As I was promoting the book, people wanted to know what I was doing for kids. Well at the time I was holding money workshops, panel discussions, and seminars to educate adults about money. I’d respond, “well I’m teaching you to teach the kids.” But soon after, after I received an opportunity to teach elementary kids about money at Marcus Garvey School and rest built from there.

My intentions have always been to educate and empower people to make healthy money decisions – changing women and people of color’s narrative about money and therefore shifting paradigms to build significant wealth because we’re all born wealthy. Every last one of us has a unique gift, talent, and/or skill to bring added value to the world. Capitalism is not evil, it’s actually a great model to allow people to monetize the wealth they hold from within.

The early days were full of self-development which still goes on today. I’ve learned to detach myself from my clients’ emotions and decisions while remaining loving and compassionate. I used to take many of their actions personal because I was so committed to their success. But I learned that I can’t be more enthusiastic about my client’s goals then they were. I no longer drag people to success. I now guide, inspire, and shift paradigms by revealing how to make their dream possible.

What do you wish you knew when you started? Is there anything you would do differently?

MP: I wish I knew the business of financial planning. I can create a plan for someone or break down how a stock works in my sleep but growing and building a business was not part of the training. I was extremely green around the ears. Learning as I went along while building my practice, being questioned about my age and how young I looked effected my self-esteem and delayed the growth of my business.

What does “success” look like for you? We’d love to hear your biggest, boldest dream? What do you think will help you achieve it?

MP: I’m living it. I work from anywhere, help people and earn money doing what I enjoy. I am successful because I am a Zeallionaire. This is a person in pursuit of making an impact in the world based on the gifts and talents that lie within them. I have successfully helped countless people build and maintain wealth, inspired many to start building wealth, and educated both young and old the principles of wealth and how money works.

My biggest dream is to empower zeallionaire principles to women entrepreneurs and kids internationally. I’ve already reach Australia. I want to see more and more women and people of color live out their ultimate life and make a difference in the world using the wealth building strategies that are more available to the masses now more than ever. I want to inspire people to let go of their fears, breakthrough their challenges, and not let their present circumstances limit what’s possible for them and the lives they touch.

What would help is being bolder and remaining consistent even when I’m discouraged. Reminding myself of my bigger goal keeps me going when the going gets tough. As an introvert it’s easy for me to stay in my shell despite the fact that I post all over social media. One would never guess I’m an introvert, however, I do what’s necessary to get my message across, but I need to level up. I need to fine tune my message and be in front of larger audiences. When I started as a financial advisor, I quickly learned that because I’m petite, soft spoken, and a black woman I’d have to be on a platform of authority to gain credibility to acquire clients beyond referrals. That’s why I hosted seminars, spoke at events, and participated on panel discussions. I needed that edge. Now I must do that in this digital age. I am currently working on getting on more podcasts and interview in the media.

What is your superpower as an entrepreneur? What is your proudest and darkest moment so far?

MP: My ears and my compassion. Money is one of those topics that people don’t talk about much. Your friends will know who you were intimate with before they know how much money you have. I listen and don’t judge. So, what I found is that in just a few minutes of me meeting someone and they learn I’m a financial planner, they spill all the beans, all the beans! My colleagues express that their clients don’t always tell them things. That has never been my issue, if anything they tell me too much! Wherever a person is in their financial journey and whatever catastrophe they think they made with their money, I assure them those were lessons learned to improve from this moment on. They have time to still reach their goals, with grace and ease.

There have been numerous proud moments, but the one I’ll share is the impact I unknowingly made when I met with a client in my office. She brought her daughter, who was in the 5th or 6th grade at the time. I conducted my meeting with her mom as I did with all my clients. I also include kids in the conversation when I meet with parents and the kids are around. I never ignore them. They get to learn too! I later learned that I opened up that little girls’ eyes to new possibilities. She had never seen a black woman up to that point in a posh professional office setting. I didn’t realize that by just showing up and doing what I love would have made such an indelible imprint in that child’s life. She is now a college graduate, about to be married and start a wonder life of her own now.

My darkest moment was when I was let go from a firm because of low production. I didn’t know at the time, but I was going through a depression. Naturally that effected my sales. I packed up my belongs when everyone left the office, I tucked my tail and left late that evening. I was embarrassed. But I regrouped, found another company and tripled my production.

What are your personal driving principals, your top values?

MP: The fact that everyone is born wealthy. We all have unique gifts, talents, and skills that will add value to any community and ultimately the world. I want to see more and more 99%’ers realize this and as a result of monetizing their gifts and talents build lasting wealth to enjoy all that life has to offer and give back to help others on a grander scale.

How have your personal principles and values shaped your company’s values and principles?

MP: I always lead with the mindset of anything is possible and everything always works out well at the end of the day. Most of my clients view their finances with a limited lens. I help them realize that they don’t have to allow their past decisions or current situation determine their future. There is always a new day riddled with new possibilities. In addition to that, I help them understand the financial planning process in a way that shatters their belief that financial independent is a long drawn-out journey. I lay out a plan based on their goals showing them their vison of early retirement, is very possible. They have the purpose and I give them the plan.

What’s it like to work alone or with your partners?

MP: Through the years It’s mostly been just me. I’ve had virtual assistants but none like the lady I have now. She is phenomenal! I realized that the previous VA’s were a part of my journey to develop clarity of what I needed and well as my leadership skills. It’s great now knowing how to delegate and have a VA that helps me with that too. She’ll say, “I’ll do that” and I appreciate having a quasi-partner. I look forward to expanding my team. Although I have let go of part of the marketing, I still wear many hats but happy to let more go now that I have a better understanding to run a company and scale. Financial coaching and running a profitable business are two very different skillsets.

Do you have a mentor? Tell us about what makes them valuable to you and your business?

MP: Yes. Over the years, I’ve had many coaches and mentors and I have people in my life I can call on for guidance. Social media has opened many doors to gain access to people I may not have otherwise had access to or find. I have a much better understanding of scaling, the duties of a CEO, and leadership. I am constantly listening to personal development videos and podcasts. I’m in a mastermind group, I host one of my own and I have a couple of people I can call to get help on my business weather it’s technical or mental/emotional.

As a result of these resources, I don’t give up no matter what challenge I’m overcoming. My spirit is lifted, paradigm is changed, or problem is solved. All the people I have around me whether it’s a direct contact or virtual have made a tremendous impact in my ability to keep believing in myself to reach higher and higher plateaus to reach my business goals.

What role does mentorship play in your world (as a mentor or mentee)?

MP: Mentorship is huge! As a mentee, it helps me grow personally and businesswise. It does that same as a mentor and I’d add that mentoring feels good to give back. I enjoy hearing the results of the mentee’s success.

Many entrepreneurs continue to perfect their daily routines to support their work and greater vision; would you mind sharing your morning routine or a regular ritual that grounds your work each day?

MP: My morning routine has pretty much stayed consistent. I’m not married and don’t have any children yet, so I didn’t have anyone to make me shift. The first thing I do when I wake up is drink a glass of water followed by 15 minutes of meditation. Then I journal for another 5-10 minutes. Following that I exercise for 15-30 minutes, shower and eat breakfast. Depending on the season, I’ll drink a green smoothie and tea or enjoy a warm bowl of oatmeal, fruit, and tea. There are days when I don’t follow this to a T but for the most part this has been my routine for roughly 15-20 years.

What are you reading or have read?

MP: I do more listening of interviews or personal development speakers like the late great Bob Proctor, Dr. Joe Dispenza, Abraham Hicks, Marianne Morrison, Shanda Sumpter, Racheal Rogers to name a few. I’ve read Think and Grow Rich about five times, The Science of Getting Rich, The Soul of Money, The Success Principles, The Seven Laws of Spiritual Success, Creating Affluence, Seven Habits of Highly Effective People, How Moved my Cheese, Getting Things Done: The Art of Stress-Free Productivity, How to Win Friends and Influence People, to name a few and numerous insurance and investment related books.

Where do you go for inspiration?

MP: I listen to Abraham Hicks, Bob Proctor, Dr. Joe Dispenza, Shanda Sumpter, Racheal Rogers, and sometimes I’ll call a friend but that’s usually to vent to create space for the inspiration.

Do you have a favorite quote, mantra, or words of wisdom to get through the tough days?

MP: Everything works for my greater good and all my needs are met. Abraham Hicks

What is a problem that keeps you up at night?

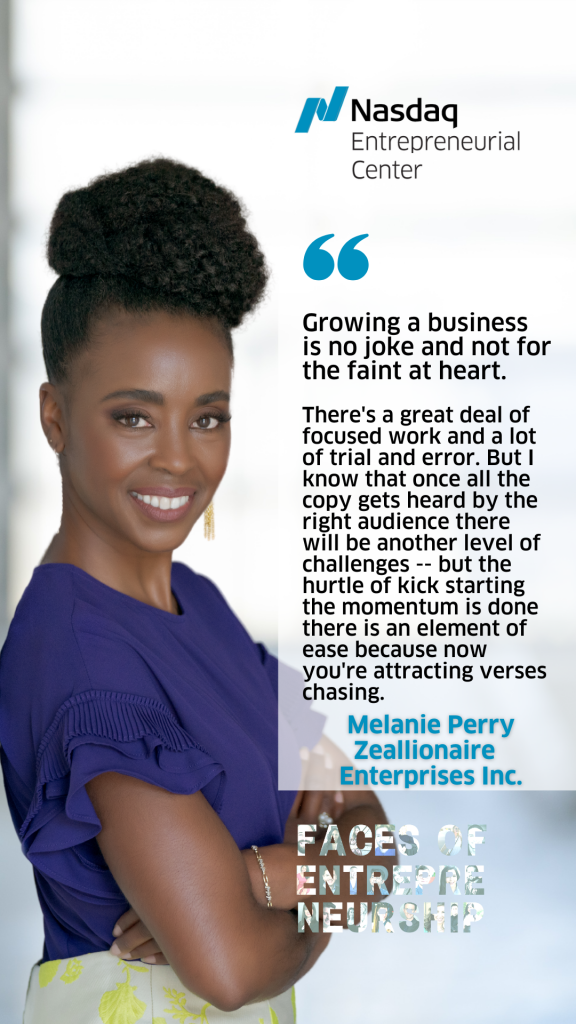

MP: I don’t stress but if I was kept up at night it be about scaling and marketing. Growing a business is no joke and not for the faint at heart. There’s a great deal of focused work and a lot of trial and error. But I know that once all the copy gets heard by the right audience there will be another level of challenges — but the hurtle of kick starting the momentum is done there is an element of ease because now you’re attracting verses chasing.

How do you think about helping others through your work?

MP: The very nature of what I do as a financial coach helps my clients gain a better understanding of money to reach their personal and business goals to add value in their family life and in the world.

What advice do you have for fellow (and aspiring) entrepreneurs building and leading teams?

MP: Don’t let the fear or reality of your present revenue stop you from working with a virtual assistant or project manager. If I hired help sooner, I would have developed my leadership and delegation skills sooner and therefore been further along.

What kind of an entrepreneur do you want to be known as – as in, what do you want your legacy to be?

MP: I want it to be known that I genuinely care about my clients and the impact they want to make in the world through their journey to become financially independent.

Do you have someone you’d like to nominate to be profiled in our Faces of Entrepreneurship series? Please let us know by emailing media@thecenter.nasdaq.org or submit your nomination using this form.